Safeguard, Administer, and Inherit Digital Assets with Confidence and Elevate Your Services to a New Level of Security, Efficiency and Compliance

Challenges in dealing with Digital Assets

Lack Of Key Transfer Options

No Visibility on Assets Under Management

Not having a clear idea of crypto assets under management is a big challenge and risk for wealth managers.

Risk & Liability

Recordkeeping and Auditing

Discover the Power of Digital Asset Protection, Administration and Inheritance Solutions"

- Unmatched Protection for your Clients' Digital Wealth.

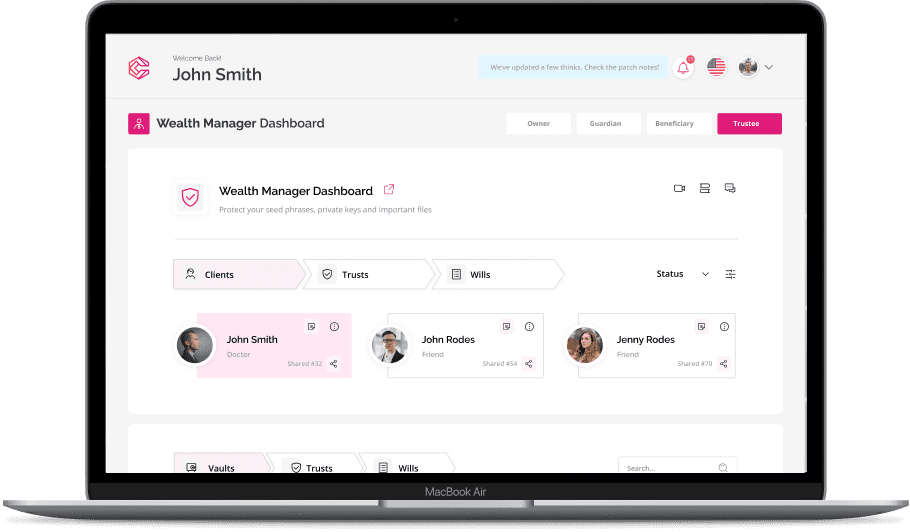

- Digital Asset Administration

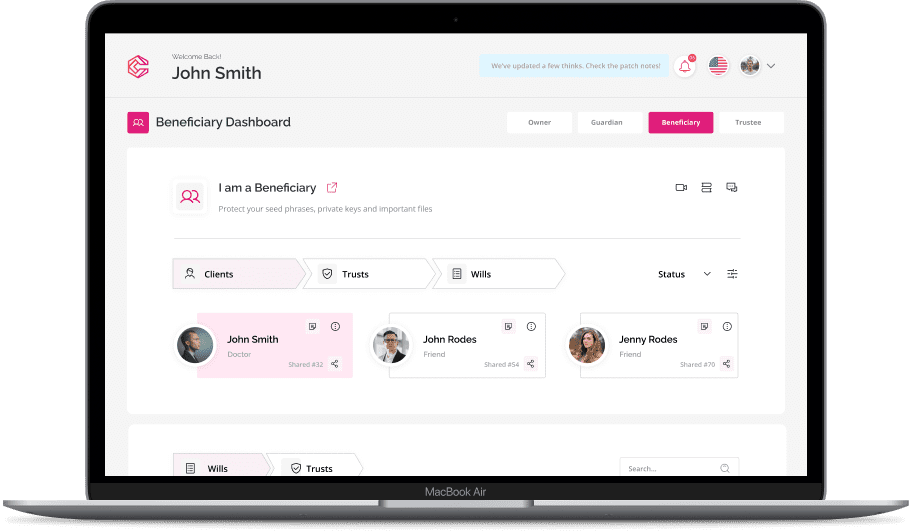

- Seamless Inheritance Planning and Smooth Distribution

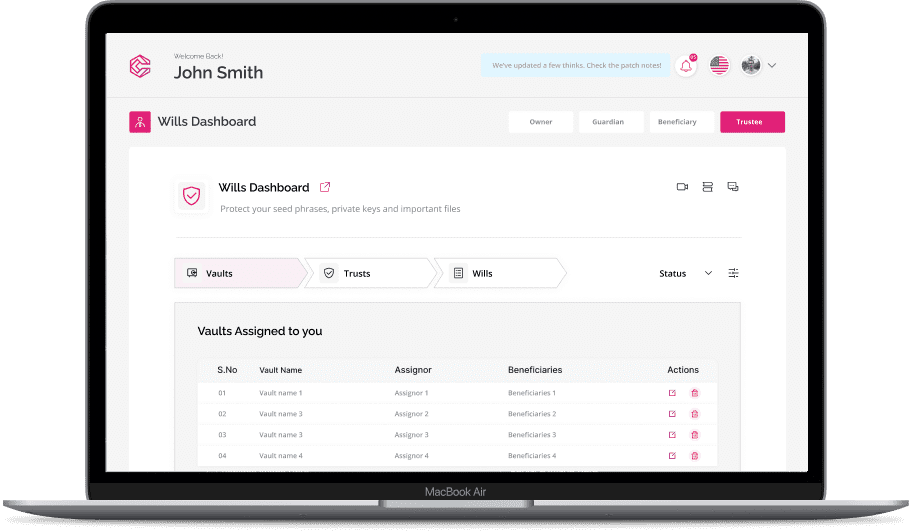

- Audit trails and compliance reporting

- White-glove service & personalized attention

- Valuable insights, knowledge via educational webinars

Elevate your practice to new heights of security, efficiency, and safeguard generational wealth transfer.

Our State-of-the-Art Security Measures

Advanced Security Measures

We use state-of-the-art cryptographic algorithms and technologies such as AES-256 Encryption, Shamir’s Secrets Algorithm, Elliptic-curve Diffie-Hellman algorithm (ECDH), and Multi-party Computation (MPC) to provide advanced security measures that protect against various threats, including quantum computing attacks.

Multi-Signature Quorum

A multi-signature quorum to ensure that only authorized parties can access the stored data. This means that multiple parties must provide their authorization before any action can be taken on the data.

Backup and Recovery Service

CryptoLegacy offers a backup and recovery service to provide extra protection against data loss or theft. The patent-pending technology splits the seed phrase and creates "Key Shares" equal to the number of Guardians. Each Key Share is encrypted with the Guardian digital signatures, ensuring only the owner can make a recovery request.

KYC and Live ID Validation

Live ID validation and KYC are required during enrollment to ensure that only authorized individuals can access the stored data.

Offline Storage

CryptoLegacy stores the data offline, meaning that it is not connected to the internet or any other network. This provides an additional layer of protection against potential hacking attempts or malware attacks.

Our topmost priority is to make sure that our users feel safe regarding their seed phrases, private keys and more. We don't SEE, TOUCH or HOLD your assets in any form.

They love it, you will too!

Javier Vicente Gonzalez

Casper Labs

“ The CryptoLegacy project is solving one of the most recurrent and important current real problems but focused on the digital assets, crypto /nfts. First they are solving the fact that the users can recover their accounts avoiding losing all their assets. Second, for the present/future they are making sure that these assets automatically are transferred to

the recipients already stated in their smart contracts. This is really important because otherwise these assets will be frozen or lost. ”

James Burns

Estate Attorney

“The most significant thing we can do for the future is provide the tools for the digital landscape that consolidates it all for those we leave behind. The future is now with Cloud Locker in my mind and once the public catches on how it work, I’m sure it will become a planning staple.”

Travisse Hansen

Co-Founder Radiant Wallet

“Crypto Legacy fills a gaping hole in Defi ecosystem. If Defi is going to

eventually surpass Tradfi then inheritance and estate planning have to

be solved - people just won’t move there money here otherwise.

CryptoLegacy saw that coming and made it surprisingly easy regardless

of which exchange or wallet you use."

Commonly Asked Questions

Cryptolegacy.ai services are designed to cater to wealth managers of various backgrounds and expertise levels. While there are no specific qualifications required, wealth managers should have a basic understanding of digital assets and their role as fiduciaries.